Tax Worksheets

Calculating worksheet tax worksheets math taxes kids some coaching aspergers our answers here Calculating sales tax worksheet Math 4th taxes

Actors Tax Worksheets

Income tax worksheet — db-excel.com Free sales tax worksheets Tax worksheets

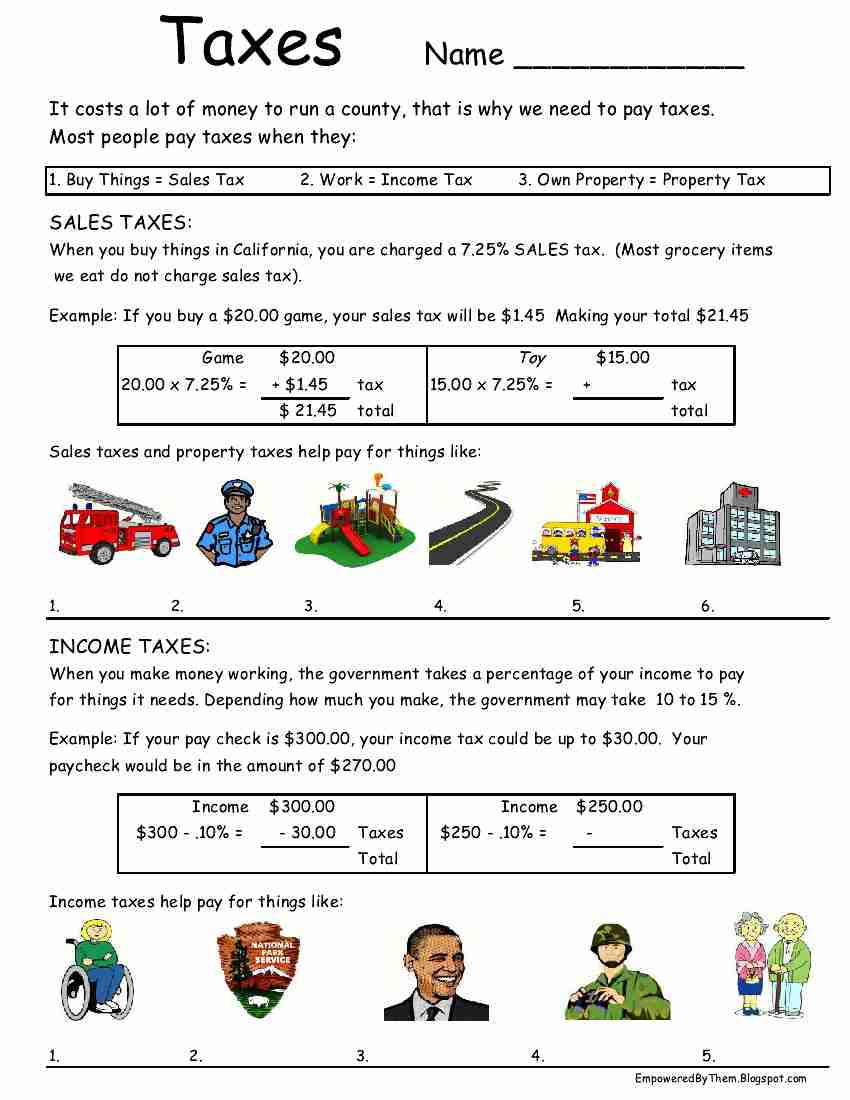

Worksheet taxes skills life tax kids income pay understanding paying reading worksheets stub students math education answer paycheck work key

Income calculating earned california helpPrintable yearly itemized tax deduction worksheet Printable tax checklists10++ free excel tax worksheet – worksheets decoomo.

Tax worksheetplaceExcel irs worksheets income Coaching our kids with aspergers: math worksheetMoney problems with tax worksheets.

Free worksheet for taxes

Income tax math / income tax basics by alt math for high schoolSmall business tax worksheets Empowered by them: taxesActors tax worksheets.

30 calculating sales tax worksheet education templateSmall business tax deduction worksheets Federal tax worksheet — db-excel.comActors tax worksheets.

Real estate agent tax deductions worksheet pdf

8 best images of tax preparation organizer worksheetTax worksheets for students Tax worksheet deduction organizer preparation deductions car income template expense expenses spreadsheet worksheeto itemized via sheet individualSales tax practice worksheets.

Sales tax worksheetsTax worksheet deduction itemized yearly Tax worksheet deduction realtors expense haller signnow10++ tax deduction worksheet – worksheets decoomo.

Commission worksheet with answers

Worksheet tax federalCalculating sales tax worksheet — db-excel.com Template for tax preparationCalculating sales tax worksheet.

10++ small business tax deductions worksheet – worksheets decoomoIncome tax worksheet — db-excel.com 10 business tax deductions worksheet / worksheeto.comTax worksheets for students.

Worksheet sales tax calculating excel db dna synthesis protein please review

Sales tax worksheetsWorksheet 1. figuring your taxable benefits: keep for your records The small business worksheet is shown in black and white, with an.

.